When deciding to get auto insurance, it’s crucial to separate fact from fiction. Numerous myths surround auto insurance, often leading to confusion and misinformed decisions about coverage. Accurate Auto Insurance is here to help debunk some common auto insurance myths and set the record straight.

Myth 1: Red Cars Cost More to Insure

Fact: The color of your car does not affect your insurance rates. Insurance companies consider factors like car make, model, engine size, and the driver’s age and driving history. The myth about red cars probably stems from the assumption that red cars are often driven faster, but in reality, color has no impact on insurance costs.

Myth 2: Your Credit Score Doesn’t Affect Your Insurance Rates

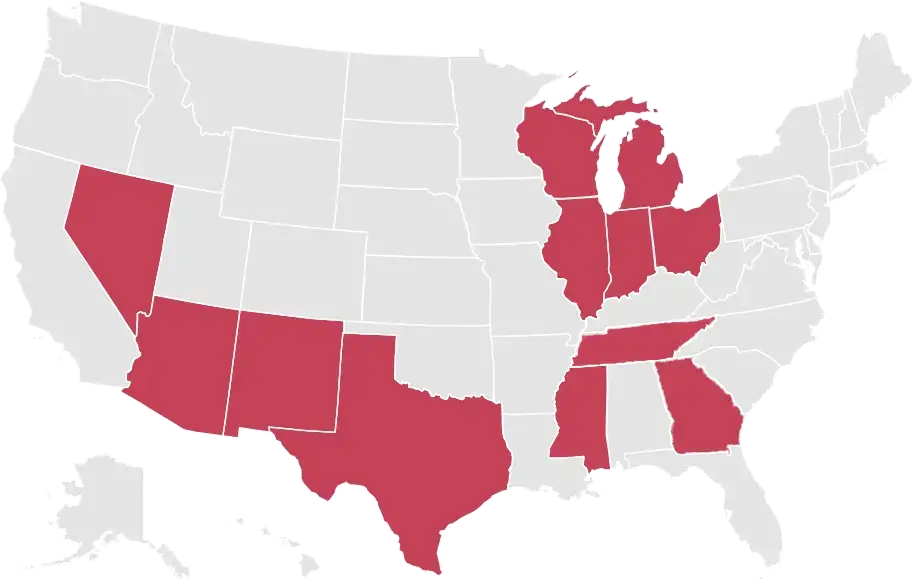

Fact: In most states, your credit score can significantly influence your auto insurance premiums. Insurers use credit scores to assess risk; statistically, individuals with lower credit scores are more likely to file claims. However, some states like California, Massachusetts, and Hawaii prohibit the use of credit scores in determining insurance rates.

Myth 3: All Auto Insurance Policies Offer the Same Coverage

Fact: There is a wide range of auto insurance policies available, each with different levels of coverage. Options vary from basic liability insurance to comprehensive coverage that includes damage from non-collision events. Understanding the differences is key to choosing the right policy for your needs.

Myth 4: Older Vehicles Always Have Lower Insurance Rates

Fact: While it’s true that older vehicles often have lower value and thus might cost less to insure, the overall rate can also depend on other factors such as the likelihood of theft, repair costs, and the vehicle’s safety record. Sometimes, older models lack modern safety features, which could potentially increase insurance costs.

Myth 5: You Only Need the Minimum Required Insurance

Fact: While carrying the minimum required insurance is legally sufficient, it might not provide adequate protection in all scenarios. Minimum coverage usually only covers liability for injury and property damage to others. Expanding your insurance to include collision, comprehensive, and possibly uninsured motorist coverage can safeguard you against a broader range of incidents.

Clearing the Confusion: The Truth About Auto Insurance

Understanding the facts about auto insurance helps in making informed decisions about your coverage. It’s important to move past common misconceptions. If you have questions about the right auto insurance for you, consult with our insurance professionals at Accurate Auto Insurance to tailor a policy that meets your needs. Remember, the right insurance policy not only meets legal requirements but also provides peace of mind on the road.